15+ Mortgage points

If you were to take on a 200000. 15-year fixed-rate mortgages.

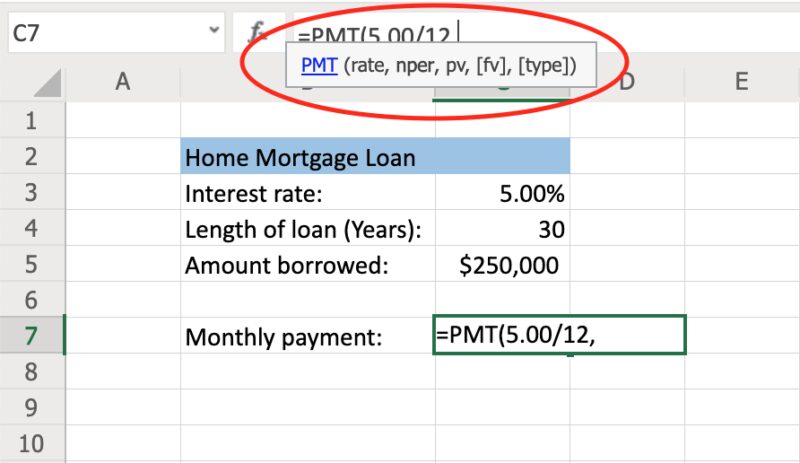

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Take Advantage Of 2022 Mortgage Rates When You Buy Your Next Home.

.jpg)

. Origination points and discount points. 1 day agoSeptember 1 2022 729 AM 15 min read. Each point you buy typically lowers your interest rate by 025 percentage.

The average rate for a 15-year fixed mortgage is 511 which is an increase of 16 basis points from seven days ago. So for every 100000 you borrow one mortgage point is worth 1000. The mortgage points calculator will help you to calculate whether or not it is going to be beneficial for you to buy mortgage points or not.

13 hours ago15-year fixed-rate mortgages. Buying one point could let you get a 525 interest rate. 197778 original total interest paid 185035 reduced total interest.

Mortgage points come in two varieties. For most home buyers a 15-year mortgage payment plus existing debts will take up more than 43 to 50 of their monthly income which is the maximum DTI range most. It would take about 55 years to reach the break-even point of 8000 before you.

The 2 mortgage discount points for 8000 at closing saves you 120 in monthly payments. The median rate for a 15-year fixed mortgage is 511 which is an increase of 16 basis points from seven days ago. Points are calculated in relation to the size of the loan with each point equal to 1 of the loan amount.

Mortgage discount points are all about playing the long game. Mortgage rates increased for the second week in a row. This type of 15-year.

In both cases each point is typically equal to 1 of the total amount mortgaged. How do mortgage points work. Each point is generally worth 25 of the interest rate.

1 day agoThe 15-year fixed rate averaged 498 13 basis points higher than last week. This process is also known as buying down. Ad Americas 1 Online Lender.

Compare Rates Get Your Quote Online Now. If you choose not to buy mortgage points your interest rate will remain at 5125. Mortgage points are fees you pay upfront to reduce your mortgage interest rate and by extension your monthly payment amount.

On a 200000 loan each point costs 2000 which means that 175 points will cost 3500. The average rate for a 15-year fixed mortgage is 525 which is an increase of 17 basis points from the same time last week. The average rate on a 30-year fixed-rate mortgage.

Whether its a 30-year or 15. Typically when you pay one discount point the lender cuts the interest rate 025. LendingTree helps simplify financial decisions through choice education and support.

Ad Get mortgage rates in minutes. One mortgage point will typically cost 1 of your loan amount and lower your interest rate by about 025. Mortgage points are fees you pay the lender to reduce your interest rate.

For example lets say you qualify for a 55 interest rate. A 15-year fixed-rate mortgages monthly payment is. As a general rule one mortgage point is equal to 1 of the mortgage amount.

Mortgage points are fees that you pay your mortgage lender upfront in order to reduce the interest rate on your loan and in turn your monthly payments. Ad NerdWallet Reviewed Mortgage Lenders To Help You Find The Right One For You. With one mortgage point youll drop that amount to 185035which saves you 12743 in total interest.

However if it takes a long time to reach your break. Compare up to 5 free offers now. Points are paid upfront.

The average interest rate for a 15-year mortgage is currently 523 compared to the 30-year mortgage rate of 603. The longer you plan to own your home the more points can help you save on interest over the life of your loan. The Mortgage Bankers Association reported a 37 mortgage application decrease from the.

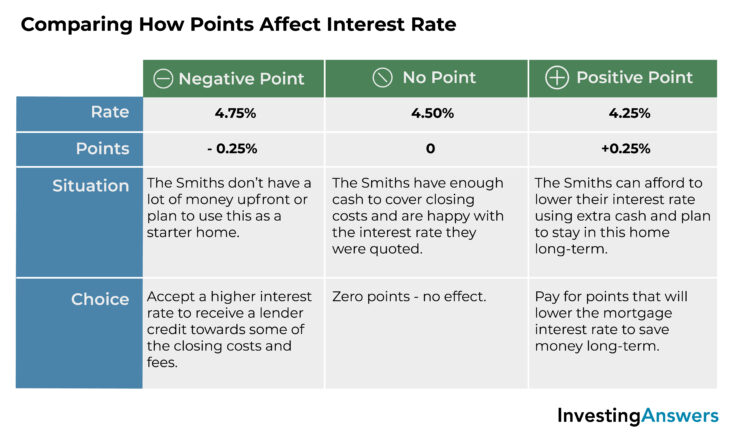

Negative Points Meaning Examples Investinganswers

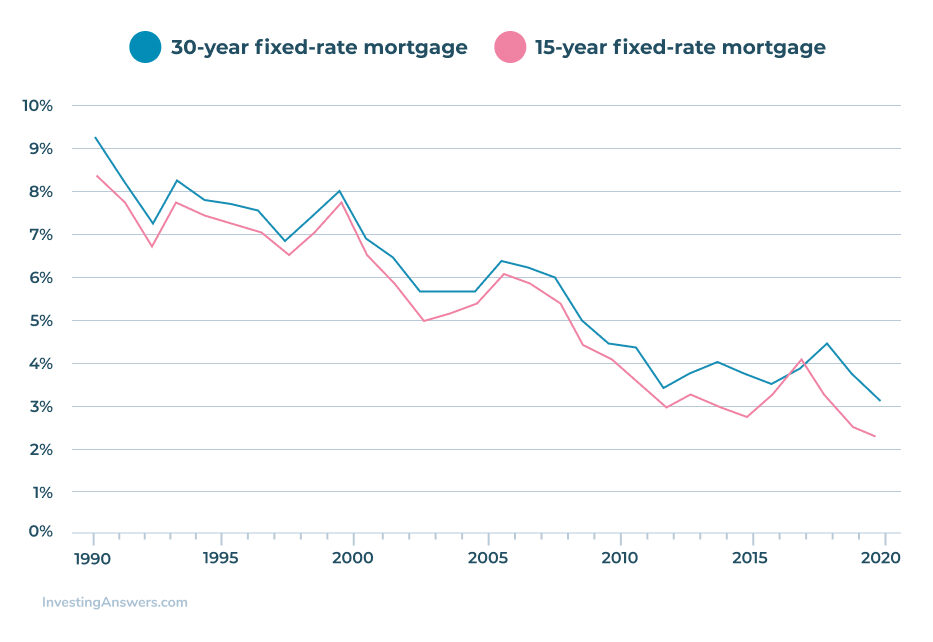

Historical Mortgage Rates In The Us Averages And Trends

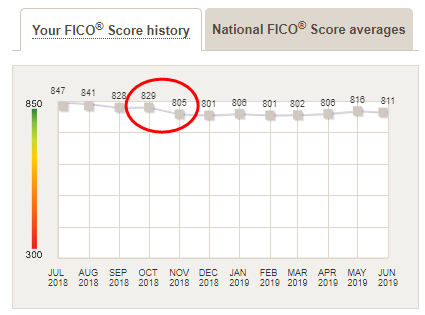

My Credit Score Dropped This Much After I Paid Off My Mortgage

How 8 Mortgage Rates Will Change The Face Of Homeownership

:max_bytes(150000):strip_icc()/mortgage-preapproval-4776405_final2-f5fbd4d3d08d4aeeb04cc12fc718ae00.png)

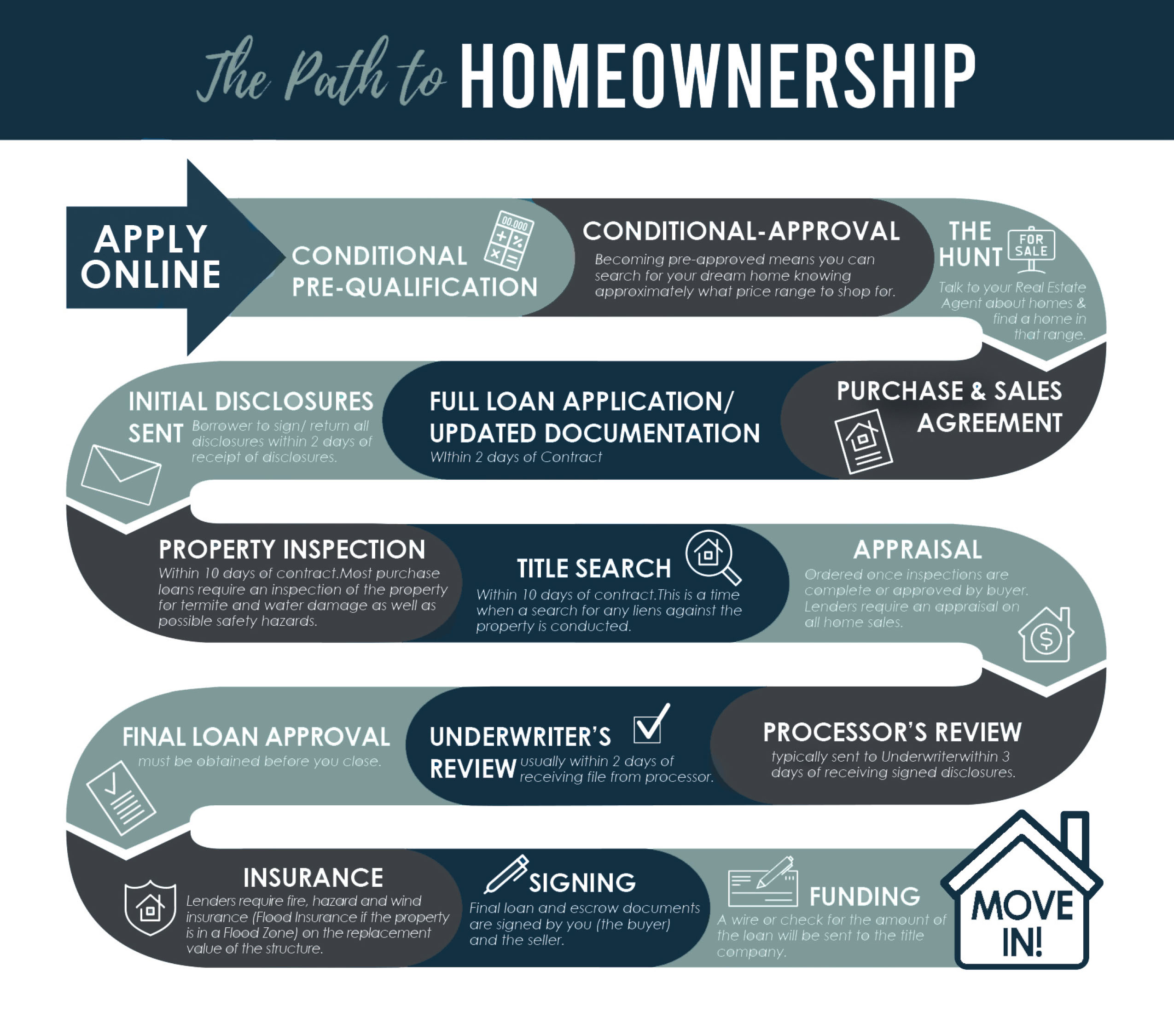

How To Get Pre Approved For A Mortgage

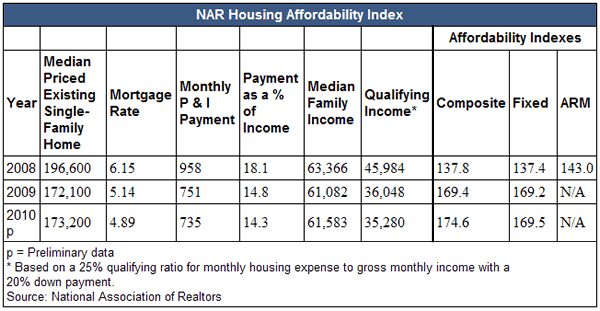

Ex99 1 015 Jpg

:max_bytes(150000):strip_icc()/average-what-can-i-expect-my-private-mortgage-insurance-pmi-rate-be.asp-d107c689ce61440b9ccc69363bbc08c0.png)

On Average What Can I Expect My Private Mortgage Insurance Pmi Rate To Be

How Much Will Cecl Impact Reserves For First Mortgage Portfolios

/average-what-can-i-expect-my-private-mortgage-insurance-pmi-rate-be.asp-d107c689ce61440b9ccc69363bbc08c0.png)

On Average What Can I Expect My Private Mortgage Insurance Pmi Rate To Be

Get Pre Approved For A Home Mortgage Financing

How Much Will Cecl Impact Reserves For First Mortgage Portfolios

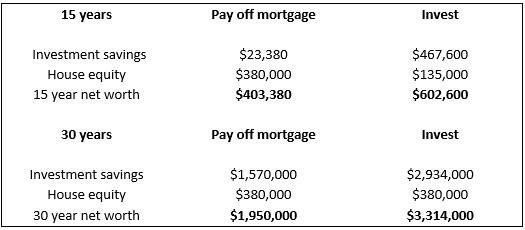

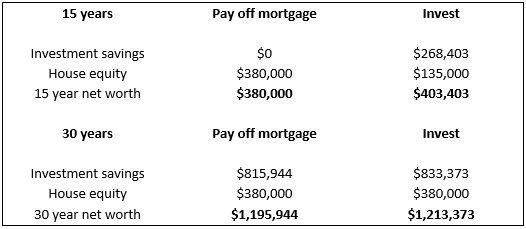

Deciding The Pay Down Mortgage Or Invest Debate Esi Money

.jpg)

Negative Points Meaning Examples Investinganswers

How To Calculate Monthly Loan Payments In Excel Investinganswers

Deciding The Pay Down Mortgage Or Invest Debate Esi Money

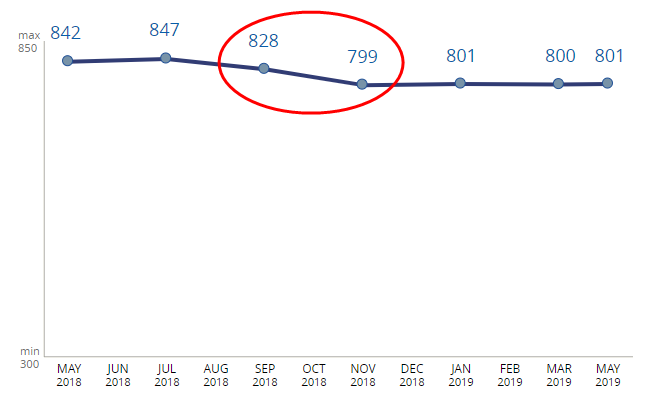

My Credit Score Dropped This Much After I Paid Off My Mortgage

How Much Will Cecl Impact Reserves For First Mortgage Portfolios